How to minimize crypto / Bitcoin investment risk?

Since its inception in 2009, Bitcoin has been one of the best-performing investments of all time. Its return has been calculated at an average of 15000 per cent per annum. Unlike real estate, gold, or other traditional investment options, cryptocurrencies are not backed by any collateral.

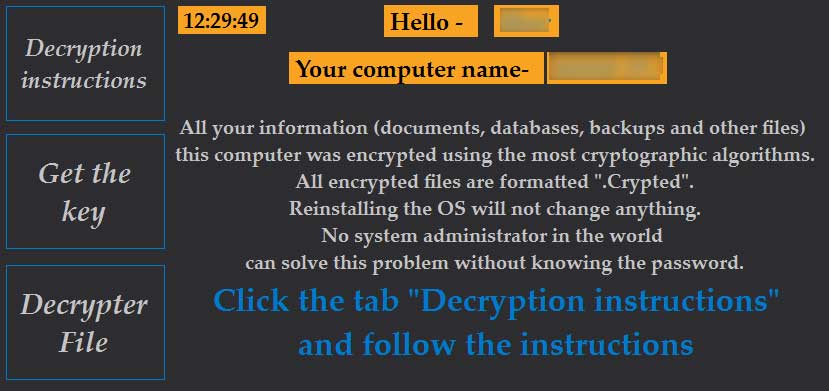

Any cryptocurrency trading without proper understanding can cost you a huge loss because of various factors like price volatility, cyber hacking, scams, or even loss of access keys can put your investment in a difficult stage. This blog will look at multiple ways to minimize the risk while investing in cryptocurrencies through useful tips.

What are the potential risks of investing in Bitcoins?

Before understanding how to protect your crypto investment, it is essential to find out the risks of investing in Bitcoins. In 2017, the price of one Bitcoin was $20,000. But for someone who purchased a Bitcoin on that date, selling it on the 24th would have been catastrophic as the price fell to less than USD 15,000. With the prices swaying back and forth, an investor will have to be extremely vigilant.

Currently, the digital currency market is being traded without the consensus of any government regulatory authority. While there are systems to mitigate this issue, safety from them remains a concern for a potential investor.

How to protect yourself from losses?

This is the million-dollar question. You can lose money if you do not invest in Bitcoins smartly, so you need to do your homework. Here, you can find some tips to minimize the risk:

- Consider using offline, also known as physical wallets for storing your cryptocurrencies. For the majority of the currency while leaving only a small amount in the online wallet for trading purposes.

- Use tested and verified security tactics such as dual passwords for your cryptocurrency accounts. The private and public keys should also be kept separately with the security of a strong password and multiple authentications wherever possible. You could limit your exposure to cyber threats by keeping unique and strong passwords that should be frequently changed.

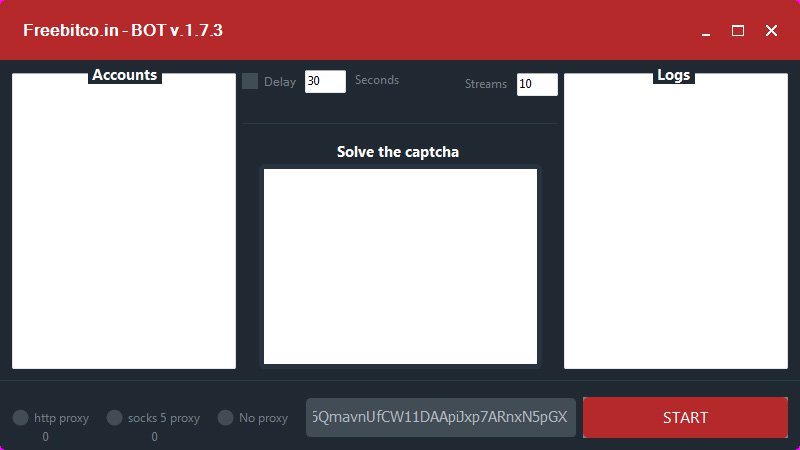

- Investors should thoroughly research the security features of trading platforms to understand how effectively their currency holding information is protected. One needs to make sure that the platforms use all possible security encryptions and air-gapped devices stored offline with cryptocurrency deposits. https://cryptotrader.software/ is an example of a safe and secure platform for investors.

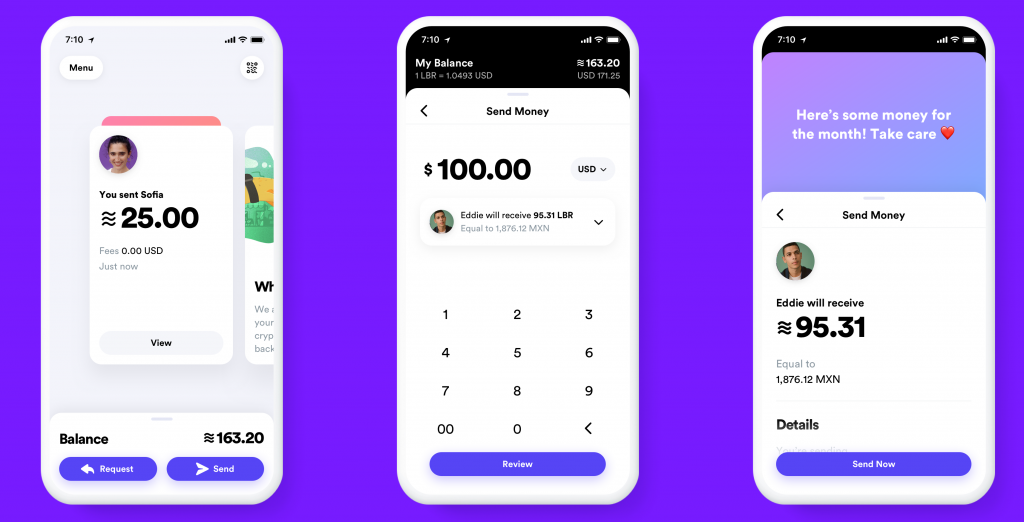

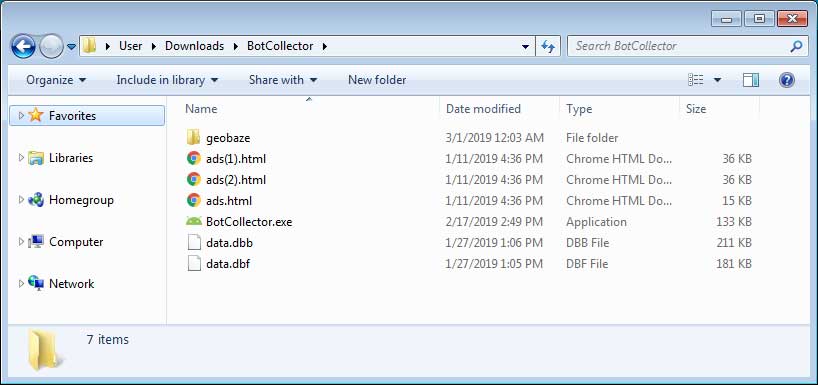

- Caution should be exercised while using mobile applications for managing cryptocurrencies. Ensure that the mobile device is not subject to phishing campaigns that can steal your confidential data and security credentials. These threats could come in texts, social media requests, or emails. There are also mobile apps that are malicious and can have a hidden ability to monitor your mobile screens.

- As the cryptocurrency market is completely technology-based, having sound knowledge of the technology used in these transactions is an added advantage. So you need to know about private key protection, recovery seed protection, and crypto-miner malware protection